When I’ve thought of Warren Buffet and Berkshire Hathaway (prior to doing a deep dive on the company) I think of their large ownership of stock in companies like Apple and Coca Cola. I also know that Berkshire owns Geico Insurance— you know that talking Gecko you used to see on TV talking in that British accent? I also think of Buffet’s reputation for being arguably the best investor of all time. After doing a deep dive on the company I’ve learned that the aforementioned doesn’t even begin to scratch the surface of the real estate occupied by Berkshire Hathaway in the global economy. I’m excited to share with you, the many businesses I’ve discovered that Berkshire owns — both wholly and partially.

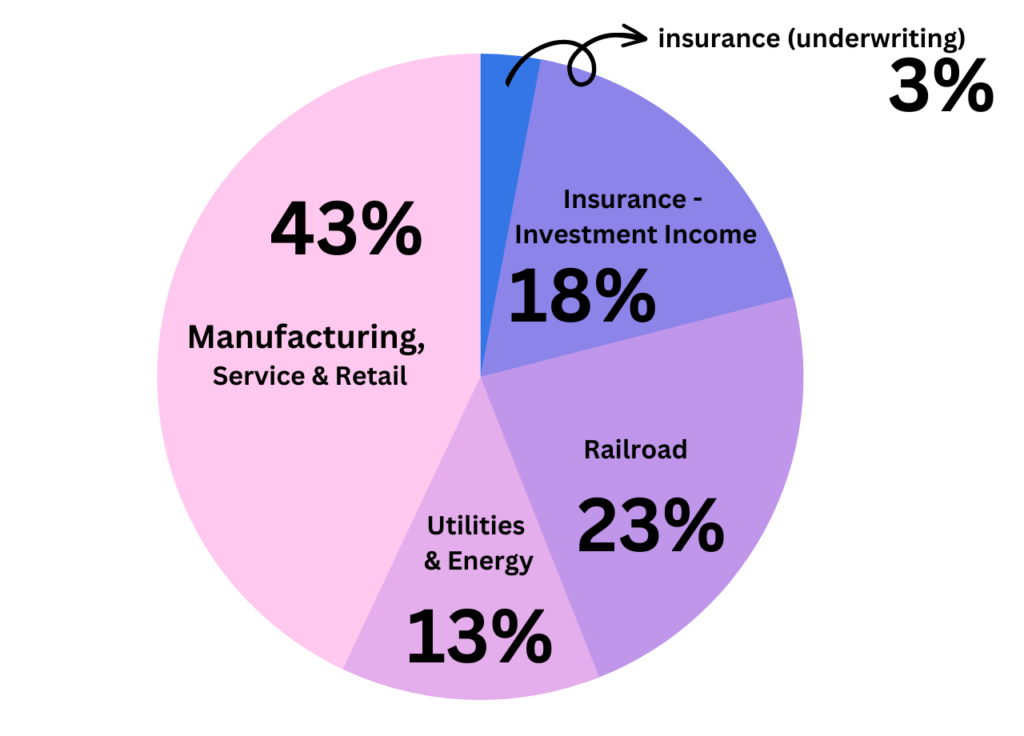

First lets look at the different ways Berkshire makes money. In 2021, its core owned and operated businesses made up just over 26 billion dollars in revenue. Its investments generated over 60 billion in profits for the business but we’ll touch on that at the end.

Insurance

Berkshire’s insurance business is split up between underwriting and investment income. The underwriting portion is made up of three companies: GIECO, Berkshire Hathaway Primary Group (BHPG) and Berkshire Hathaway Reinsurance Group (BHRG).

Geico

Yes, that aforementioned talking lizard mascot that advertised home and auto insurance on the television — is owned by Berkshire Hathaway. So how big is the business? Well Geico is a direct competitor of State Farm, All State, Progressive and USAA. It is the second largest Auto Insurer in the United States, behind State Farm.

BHPG

Berkshire Hathaway Primary Group is made up of 7 different Insurance businesses. These businesses operate both locally in the United States and globally in countries such as Australia, New Zealand, Canada, parts of Asia, Europe and the Middle East.

BHRG

Berkshire Hathaway Reinsurance Group is its combined global reinsurance business that offers a wide range of coverages on property, casualty, life and health risk to insurers and reinsurers worldwide. BHRG conducts business activities in 24 countries.

Insurance – Investment Income

Berkshire’s consolidated float grew from 91 billion in 2016 to 147 billion at the end of 2021. This figure is the combination of shareholder capital and funds from policy holders via their insurance and reinsurance business.

Railroad

Burlington Northern Santa Fe (BNSF) operates one of the largest railroad systems in North America and employs approximately 35,000 people. The operations of this business brought in over 22 billion dollars in revenue in 2021. This railroad system transports consumer, industrial and agricultural products, along with coal.

Utilities and Energy (BHE)

Berkshire Hathaway Energy Company is a global energy company with subsidiaries and affiliates that generate, transmit, store, distribute and supply energy. BHE’s local business is made up of four regulated utility companies. These four companies service approximately 5.2 million retail customers and five interstate natural gas pipeline companies. BHE’s Great Britain electricity distribution subsidiary serves 3.9 million electricity end-users. Great Britain’s (BHE subsidiary) electricity transmission-only business in Alberta (Canada) serves approximately 85% of Alberta’s population.

Home Services of America

Home Services of America is the largest residential real estate brokerage firm in the United States. Its additional offerings include mortgage originations and mortgage banking, title and closing services, property and casualty insurance, as well as home warranty and relocation services. Moreover, it is home to 46,000 real estate agents in over 900 offices in the United States. In addition, its franchise network includes 360 franchisees which are primarily in the United States but also international. Its franchise network has over 1600 brokerage offices with over 53,000 real estate agents.

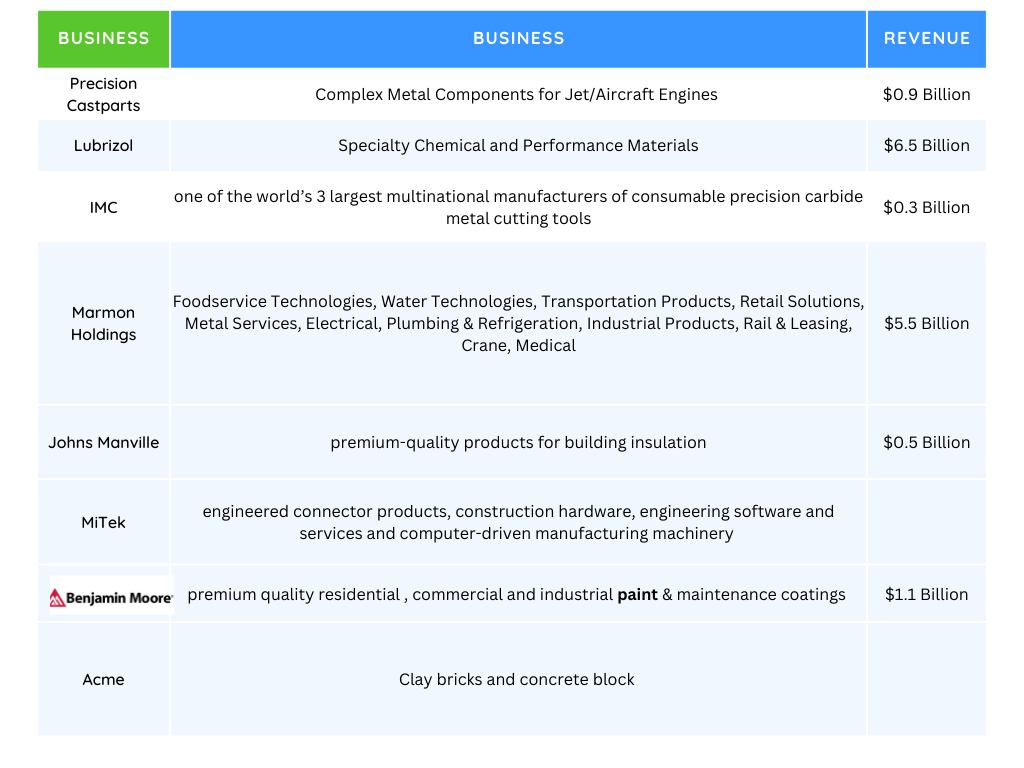

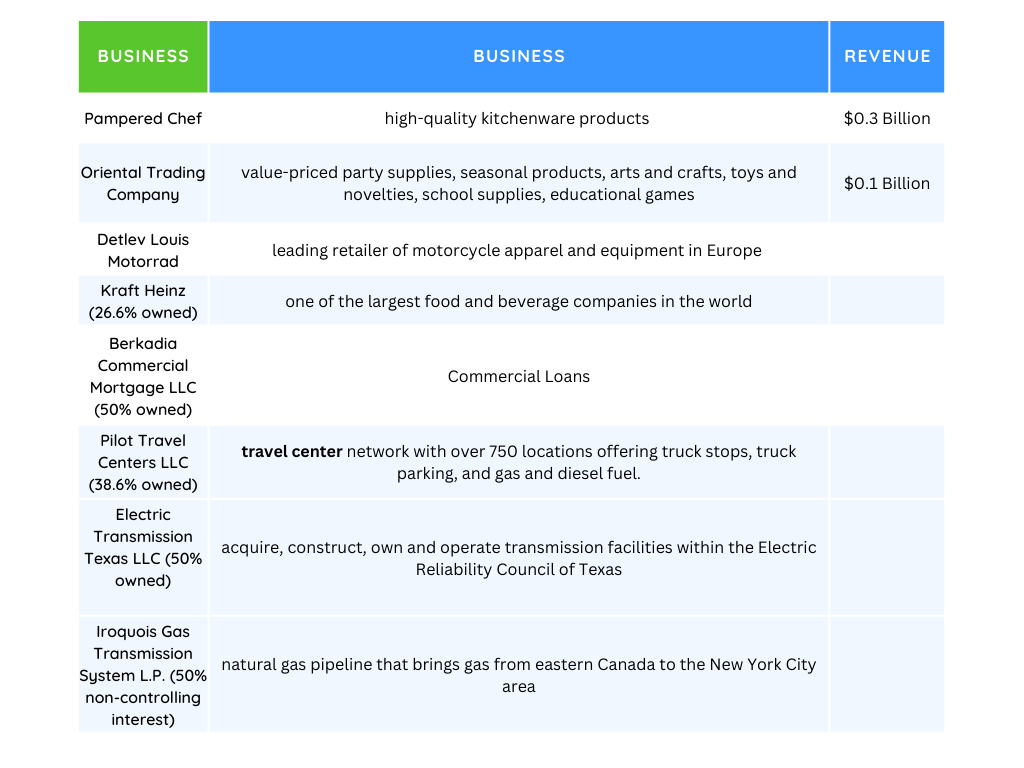

Manufacturing, Service, and Retail

Investments

Finally, we arrive at the part of the Berkshire machine. This part of the business is how the average person views Warren Buffet — having billions of dollars in investments in blue-chip household companies. Its largest investments in terms of cost are Apple and Bank of America. Below are the companies that Berkshire holds large positions in and how much of the overall business it owns:

- American Express (20%)

- Apple (6%)

- Bank of America (13%)

- Bank of New York Mellon (8%)

- BYD co. (8%)

- Charter Communications (2%)

- Chevron (2%)

- Coca Cola (9%)

- General Motors (4%)

- ITOCHU [converse, Dole, etc.] (6%)

- Mitsubishi (6%)

- Mitsui & Co. (6%)

- Moody’s (13%)

- U.S. Bancorp (10%)

- Verizon (4%)

Note: all figures were retrieved from the 2021 Berkshire Hathaway Annual report and rounded up for simplicity.