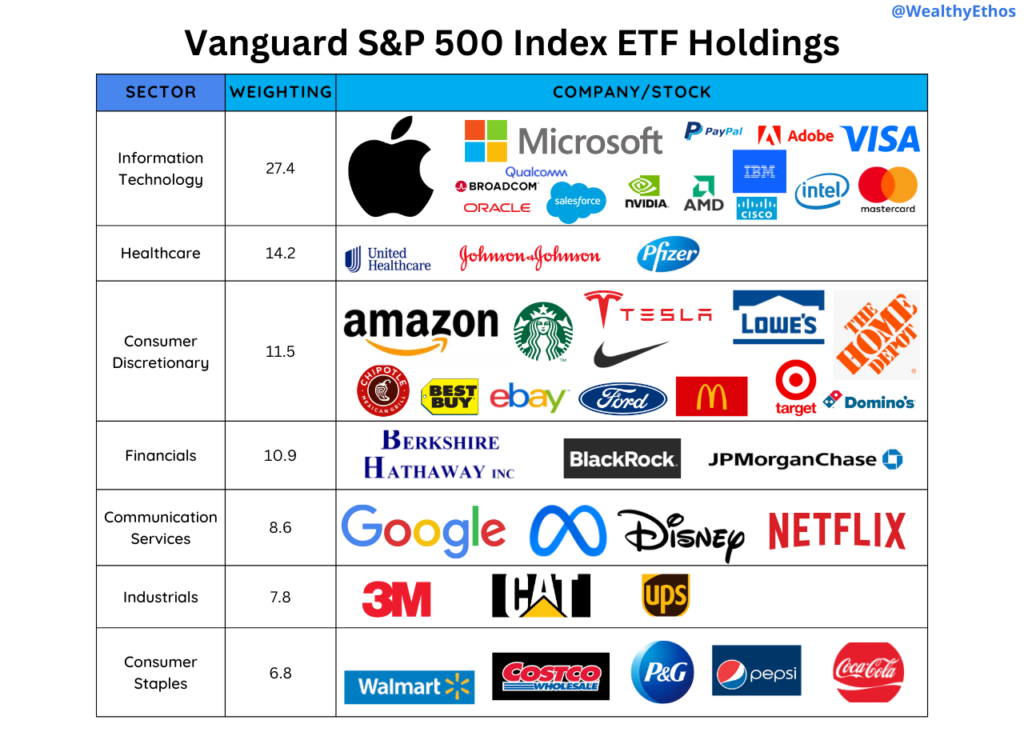

The Vanguard S&P 500 Index ETF is my go-to ETF for investing in the U.S. stock market. It tracks the performance of the S&P 500 index as closely as possible prior to fees and expenses. Speaking of fees, it has arguably one of the lowest fees around with an MER of 0.09%. In addition, this fund pays out a quarterly dividend with a 1.25% yield. This fund has 505 holdings, consisting of mainly large and medium cap companies. The fund is weighted to mirror the S&P 500 index as much as possible. This can be seen in the graphic below.

It has been proven time and time again that actively investing in individual stocks fails to beat the benchmark of the S&P 500 over long periods of time. I am a big proponent of passive index investing for the average person wanting to participate in the stock market.

What is the S&P 500?

The S&P 500 index is a market cap weighted index of the 500 leading publicly traded companies in the United States. The index is made up of mainly large cap companies. The index is broken up into 11 sectors. These sectors are (in order of weighting) Information Technology, Healthcare, Financials, Consumer Discretionary, Industrials, Communication Services, Consumer Staples, Energy, Utilities, Real Estate and Materials.

S&P stands for Standard and Poor’s which were initially two separate entities. The first S&P index launched in 1923 as a joint project by the Standard Statistical Bureau and Poor’s Publishing. This initial index covered 233 companies in 26 different industries. Both Standard and Poor merged in 1941 to form Standard & Poor’s or S&P Global (since 2016).

S&P Performance

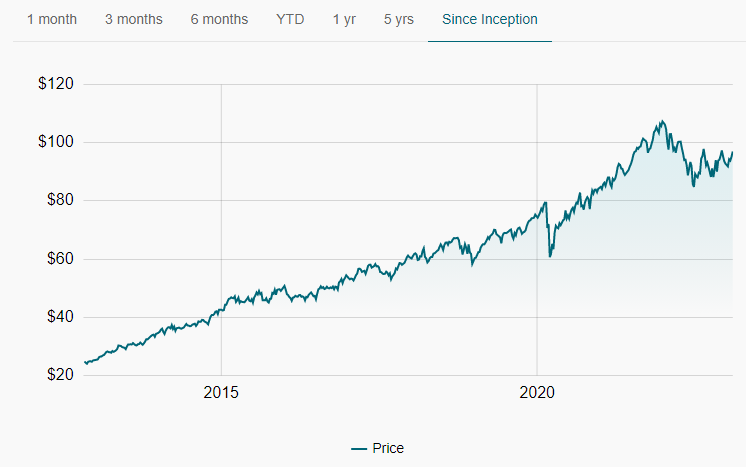

The S&P 500 index has provided an annual return of 9.8% since its inception in 1926. However, this does not mean it has had years with a negative return. There have been years where the index has declined 30%. The index has delivered increases 70% of the time, since 1926. Moreover, since 1983 the S&P 500 is up 2694% or an annualized return of 67%.

The motivation behind this post is to illustrate in a general sense, what household names make up the S&P 500. Moreover, to point to the fact that the Vanguard S&P 500 Index ETF (VFV.TO) allows you to own all these names and participate in the growth of the American economy. This participation will come without having to exchange your dollars into USD, rather you will be able to purchase shares in Canadian dollars. I created this chart to illustrate to some familiar companies which this fund is invested in.

Some of the top weighted companies in this fund include Apple, Microsoft, Amazon, Alphabet (Google), Berkshire Hathaway and Tesla.

Fund Performance

This fund came into inception on November 2nd, 2012 and has provided an overall return of 292.39% or approximately a 29% annualized return over the last 10 years. $10,000 invested in 2012 would have grown to $29,239 in 2023.